When we talk about running a successful business, risk management isn’t just a fancy term—it’s the backbone of sustainability and excellence. Whether you’re a seasoned entrepreneur or just starting out, understanding and implementing risk management strategies is like having a skilled navigator on a potentially tumultuous sea. It guides you safely to your destination: Improving performance and business success.

Contents

- The Pillars of Excellence: Corrective, Improvement & Risk Management

- Crafting Your Safety Net: Risk Management Basics

- The Path to Improvement: Approaches That Work

- Integrating Excellence into Your Strategy

- Case Studies: Success Stories and Cautionary Tales

- Taking Proactive Measures: Preventive Tactics

- Spotlight on Technology: Digital Transformation

- Frequently Asked Questions

- What Is Risk Management and Why Is It Important?

- How Do Corrective Actions Improve Safety and Quality?

- What Is the Difference Between Corrective and Preventive Actions?

- How Can I Establish a Continuous Improvement Culture in My Organization?

- What Role Does Communication Play in Effective Risk Management?

Key Takeaways

- Risk management is essential for identifying and mitigating potential threats to your business.

- Corrective actions are steps taken to fix problems after they occur, ensuring they don’t happen again.

- Continuous improvement is a proactive approach that seeks to enhance processes and prevent issues before they arise.

- Assessment tools like SWOT analysis and risk audits are invaluable for thorough risk evaluation.

- Empowering your team with the right knowledge and tools is crucial for effective risk management.

The Pillars of Excellence: Corrective, Improvement & Risk Management

Think of your business as a building. The stronger the pillars, the more resilient the structure. In the world of business, these pillars are corrective actions, continuous improvement, and risk management. They work together to uphold the integrity of your operations, even when faced with unexpected challenges. There’s a difference with two people that know of a problem. The person who knew of it and did nothing the other that learned why the problem occurred. This is why MSI sees how a strong Corrective, Improvement and Prevention programs can be so powerful. The challenge is to prevent the programs from being a negative connotation or a way of punishing employees as ultimately the reasons are because of lack or break-down of systems. We encourage to empower all employees to raise issues no matter what.

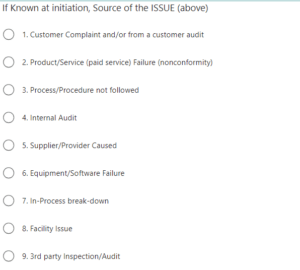

Sources of Corrective Actions

Diving into Risk Management

Risk management isn’t about avoiding risk—because that’s impossible. It’s about knowing what you’re up against and having a plan to deal with it. Imagine you’re a ship captain. Better to know what could go wrong, the likelihood and methods chosen to mitigate in advance. You can’t stop a storm from coming, but you can prepare your ship and crew to weather it. A risk management approach became more adopted in the 2015 version of the ISO 9001 Standard and replace preventive action. However, ISO 13485 (medical device) still requires a preventive management component.

Corrective Actions: What Are They?

Now, what happens when a storm hits and something on your ship breaks? You fix it, right? But you don’t just patch it up; you figure out why it broke and how to strengthen it so it won’t break again in the next storm. That’s what corrective actions are all about. For each corrective action it is required to cross reference to your risk analysis and to update as necessary.

Continuous Improvement in Plain Language

And while you’re at it, you don’t stop with fixing what broke. You look around and ask, “How can I make the whole ship stronger?” That’s continuous improvement—constantly tweaking and reinforcing before anything goes wrong. In businesses, stronger companies come up with annual initiatives to concentrate as to improvements to be made by a certain time like maybe a new ERP.

Crafting Your Safety Net: Risk Management Basics

Let’s break it down. Risk management is your safety net. It’s a systematic approach to identifying, assessing, and responding to risks. And it’s not just about preventing financial loss; it’s about protecting your people, your reputation, product integrity and your future.

Understanding Risks: More Than Just Guesswork

Understanding risks involves more than just guesswork. It’s a methodical process that looks at what could go wrong, how likely it is to happen, and what the consequences could be. It’s about asking the right questions and not shying away from the tough answers.

Assessment Tools That Make a Difference

There are tools that can help you here. Think of them as your business’s weather forecasting equipment. They help you see the storm before it’s on top of you. A SWOT analysis, for example, looks at your Strengths, Weaknesses, Opportunities, and Threats. Risk audits, on the other hand, are like a thorough inspection of your ship, checking for any weak spots. Most importantly, though are the semi-annual Management Reviews as more is analyzed and reviewed at these by the right leaders. see our tool kits Management Review tool kits many version Standards as well as a version for those companies that are not yet ISO certified.

Real-Life Scenarios: Corrective Action Examples

Imagine a bakery that found plastic shards in one of its bread loaves. A corrective action would be to not only remove the affected loaves but also to investigate the source. It turned out to be a broken machine part. The bakery replaced the part and then scheduled regular maintenance checks to prevent future occurrences. That’s corrective action in a nutshell—addressing the immediate issue and preventing it from happening again.

The Path to Improvement: Approaches That Work

Improvement is a journey, not a destination. It’s about making better choices every day. For instance, a construction company might notice that their building projects are often delayed. By analyzing their processes, they found out that ordering materials too late was the culprit. Their improvement approach? A new protocol for earlier material orders, reducing delays and increasing customer satisfaction.

Utilizing Feedback for Growth

Feedback is a goldmine. Let’s say you run a software company, and your users report that the app crashes frequently. You take that feedback, update the code, and the crashes stop. But you don’t stop there. You keep asking for feedback, continuously improving the app’s performance and usability. That’s how feedback fuels growth.

Innovation: Risk Management’s Best Friend

Innovation in risk management is like having an ace up your sleeve. It gives you a competitive edge.

When a logistics company implemented GPS tracking for their fleet, they not only improved delivery times but also reduced the risk of theft and loss. Innovation isn’t just about being new; it’s about being better and safer.

Because risk is ever-present, businesses that innovate stay ahead. A retail store might use data analytics to predict shopping trends, which helps them stock up on the right products at the right time—reducing the risk of overstocking and understocking.

Therefore, always be on the lookout for technological advancements or process improvements that can mitigate risks. It could be as simple as adopting a new communication tool that keeps your team connected and informed.

Integrating Excellence into Your Strategy

Excellence isn’t just a buzzword; it’s the result of a well-executed strategy. It involves setting high standards and then systematically working to meet or exceed them. This means integrating risk management into the very fabric of your business operations and having a structured documentation system.

Aligning Your Team With Best Practices

To achieve excellence, everyone on your team needs to be rowing in the same direction. This means training your staff in best practices for risk management. It could be as simple as regular safety drills or as complex as certification in industry-specific risk assessment techniques.

Communication: The Lifeline of Effective Management

Clear, open communication channels are the lifeline of any risk management strategy. When a customer service rep at a tech company noticed a pattern of complaints about a particular product feature, they communicated this to the product team. The feature was redesigned, and customer satisfaction soared. That’s the power of effective communication—it turns problems into opportunities.

Case Studies: Success Stories and Cautionary Tales

Learning from others can be just as valuable as firsthand experience. A multinational corporation’s quick response to a data breach saved them millions and preserved their reputation. On the flip side, a small business that ignored the warning signs of financial distress went bankrupt. These stories serve as powerful lessons in the importance of proactive risk management.

Learning from the Finest: Excellence in Action

A tech giant is renowned for its innovation and risk management. When they noticed a flaw in one of their devices, they didn’t just fix it; they also launched an awareness campaign to educate users on the issue, reinforcing their commitment to customer safety and satisfaction.

Understanding Failures: What Went Wrong?

Conversely, a once-popular restaurant chain ignored repeated health code violations until it was too late. A major food poisoning incident led to lawsuits and the eventual closure of the business. This cautionary tale highlights the cost of neglecting risk management.

Taking Proactive Measures: Preventive Tactics

Prevention is better than cure. By implementing preventive measures, you can avoid many risks before they even materialize. For example:

- Conducting regular employee training to prevent workplace accidents.

- Using encryption to protect against data breaches.

- Implementing strict quality control to ensure product safety.

These steps help create a culture of safety and responsibility within your organization.

Most importantly, preventive tactics save time and resources in the long run. It’s like fixing a small leak in your roof immediately rather than waiting for it to turn into a costly repair job.

Building Robust Processes to Avoid Future Issues

Robust processes are your business’s immune system—they help you resist and recover from setbacks. By documenting processes, you not only create a blueprint for success but also make it easier to identify and rectify issues quickly.

Accountability and Maintenance: Ensuring Consistency

Accountability means holding everyone to the same high standards. When a mistake happens, it’s not about pointing fingers; it’s about learning and improving. Regular maintenance, whether of equipment or processes, ensures that your business runs smoothly and efficiently, reducing the likelihood of issues that could derail your path to excellence.

Monitoring and evolving are critical components of risk management. As the business environment changes, so too must your approach to risk. You wouldn’t use an old map to navigate new waters, would you? The same goes for risk management—you need to keep your strategies fresh and relevant.

Why Adaptability is Key in Risk Management

Adaptability is your ability to respond quickly to changes. It’s what keeps you afloat when the unexpected hits. For instance, a company that quickly adapts its production line to meet the surge in demand for hand sanitizers during a pandemic not only capitalizes on a new opportunity but also mitigates the risk of financial downturn due to a decrease in their regular product sales.

Tools and Techniques for Modern Risk Professionals

Modern risk management is about having the right tools in your arsenal. It’s the difference between using a telescope to look ahead or trying to spot danger with the naked eye. Tools like risk management software can provide you with real-time data and analytics, allowing you to make informed decisions swiftly.

Spotlight on Technology: Digital Transformation

Technology has revolutionized risk management. Digital transformation means integrating technology into all areas of your business, fundamentally changing how you operate and deliver value to customers. It’s not just an upgrade—it’s a complete overhaul of your risk management practices.

Leveraging Tech for Better Outcomes

Leveraging technology leads to better outcomes. For example, a logistics company that uses drones to monitor their warehouses can detect potential safety hazards before they cause accidents. It’s about using technology to do more than you could with traditional methods.

Data-Driven Decisions in Risk Management

Data is the currency of modern business, and in risk management, it’s no different. Making data-driven decisions means that you’re not guessing—you’re relying on hard facts and patterns. A retail company might analyze customer data to identify theft patterns, allowing them to place security where it’s needed most.

Frequently Asked Questions

What Is Risk Management and Why Is It Important?

Risk management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. It’s important because it helps businesses prepare for the unexpected, minimize losses, and capitalize on opportunities.

How Do Corrective Actions Improve Safety and Quality?

Corrective actions address the root cause of a problem to prevent its recurrence. By doing so, they improve safety by reducing the chances of accidents and enhance quality by ensuring that the same error doesn’t happen twice.

What Is the Difference Between Corrective and Preventive Actions?

Corrective actions are taken after a problem has occurred, to prevent it from happening again. Preventive actions are taken to avoid problems before they occur. Both are essential for a robust risk management strategy.

How Can I Establish a Continuous Improvement Culture in My Organization?

To establish a continuous improvement culture, encourage feedback, reward innovation, provide training, do process reviews Ie internal audits which ensures procedures are improved upon and updated MSI performs Internal Audit and Yearly Maintenance. Make it clear that every team member has a role to play in making the business better.

What Role Does Communication Play in Effective Risk Management?

Communication is the glue that holds risk management together. It ensures that everyone is aware of potential risks and their roles in mitigating them. Open lines of communication also mean that problems can be reported and addressed quickly.